Content

Since it is January, she prepares a balance sheet listing her assets, liabilities, and owner’s equity as of December 31 of the previous year. The book value of owner’s equity might be one of the factors that go into calculating the market value of a business. But don’t look to owner’s equity to give you a complete picture of your company’s market value.

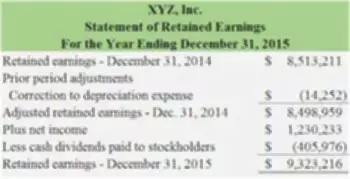

The statement of retained earnings shows whether the company had more net income than the dividends it declared. To calculate owner’s equity, subtract the owner’s liabilities from total assets.

Accounting Equation Outline

To calculate the owner’s equity for a business, simply subtract total liabilities from total assets. Subtract $150,000 from $500,000 to compute the owner’s equity of $350,000. If you run or invest in a business, you need to know how to calculate owner’s equity. This measure of a firm’s value is reported each quarter and annually on the balance sheet, which is one of the standard financial statements firms must prepare.

Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground. The CFS is, therefore, more comprehensive with regard to understanding the financial health of a company, but does not offer the same type of transparency into any specific line item. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. For example, many soft-drink lovers will reach for a Coke before buying a store-brand cola because they prefer the taste or are more familiar with the flavor.

How to Document Owner’s Equity

Next, calculate all the business’s liabilities — things such as loans, wages, salaries and bills. What’s left is the net worth, or how much equity the owner has in the business. A business starts with an idea — a product or service to produce and sell. Before the company begins its operations, it may need capital investments to achieve its goals. For example, the company may need to acquire inventory, purchase machinery and equipment, and build or rent office space. Assets are a company’s resources — the items bought, created, and owned by the company. As the initial cash capital runs out and the company incurs more expenses, it may need loans or lines of credit.

- No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

- To put it simply, subtract expenses from revenue to arrive at a company’s net income.

- Subtract total liabilities from total assets to arrive at shareholder equity.

- He became a member of the Society of Professional Journalists in 2009.

- In terms of the balance sheet values, we’ll start with retained earnings.

It may also be known as shareholder’s equity or stockholder’s equity if the business is structured as an LLC or a corporation. You can compare balance sheets from different accounting periods to determine whether your owner’s equity is increasing or decreasing. To simplify this process, Ramp has created a single platform that brings cohesion to the full spectrum of accounting activities across an organization. An income statement, or profit and loss (P&L) statement, is a report detailing how much revenue your company earned over a reporting period. In order to land on an accurate read of P&L, you will need to calculate based on a variety of other factors, including recurring costs and operating expenses. Income statements are critical because they get down to the bottom line of how well your business is currently performing in terms of revenue generation.

How To Calculate Owner’s Equity or Retained Earnings

Also, preferred stockholders generally do not enjoy voting rights. However, their claims are discharged before the shares of common stockholders at the time of liquidation. Generally, increasing owner’s equity from year to year indicates a business is successful. Just make sure that the increase is due to profitability rather than owner https://www.bookstime.com/ contributions keeping the business afloat. Owner’s equity is essentially the owner’s rights to the assets of the business. It’s what’s left over for the owner after you’ve subtracted all the liabilities from the assets. If you are a sole proprietor or partner, you or you and your partners are entitled to everything in your business.

The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business. It is obtained by deducting the total liabilities from the total assets. The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet. The owner’s equity is always indicated as a net amount because the owner has contributed capital to the business, but at the same time, has made some withdrawals. Once the above calculations have been made, the company’s total liabilities are subtracted from the total assets to reveal the ending equity balance or total retained earnings for the accounting period. The result of this calculation represents the company’s total liabilities. For business owners, an owner’s equity statement can be an effective tool to understand changes in a company’s net worth and inform future decision-making.

Other examples of owner’s equity are proceeds from the sale of stock, returns from investments, and retained earnings. Sue is right on how is owner’s equity calculated the middle of Florida’s busy season, the winter. She has snowbirds from all across the northern states flying in to buy her seashells.

- The profit is calculated on the business’s income statement, which lists revenue or income and expenses.

- The headline, like any financial statement, consists of 3 lines.

- It is calculated by getting the difference between the par value of common stock and the par value of preferred stock, the selling price, and the number of newly sold shares.

- If negative, the company’s liabilities exceed its assets; if prolonged, this is considered balance sheet insolvency.

- Owning stock in a company gives shareholders the potential for capital gains and dividends.

- When a business goes bankrupt and has to liquidate, equity is the amount of money remaining after the business repays its creditors.

Calculating owner’s equity is easy to calculate in most cases. When you have that information at your disposal, you’ll be prepared to prove that your business is healthy to a potential lender or buyer.

Components of Owner’s Equity

So, the simple answer of how to calculate owner’s equity on a balance sheet is to subtract a business’ liabilities from its assets. If a business owns $10 million in assets and has $3 million in liabilities, its owner’s equity is $7 million. Divide the total business equity by the percentage each owner owns.

Return on Equity (ROE): Definition and how to calculate it – Business Insider

Return on Equity (ROE): Definition and how to calculate it.

Posted: Mon, 19 Sep 2022 07:00:00 GMT [source]

Leave A Comment